LASTING IMPACT

Drive positive change through your impactful MICE eventsSUSTAINABILITY

Host sustainable events in SingaporeASSISTANCE SCHEMES

Funding programmes that empower world-class events

MICE Event Legacy Toolkit

This Toolkit is designed to help event planners understand legacy and impact, and embark on creating their own.

- Get clear measurement frameworks

- Equip yourself with practical tools

- Be inspired by case studies

Plan your next event in Singapore

Explore our world-class MICE infrastructure

Browse over 1,700 venues to find the best event space for your needs.

Host Sustainably

Explore Singapore’s innovative green solutions to reduce the environmental footprint of your event.

MICE Suppliers

Our local experts are ready to support your event arrangements.

Assistance Schemes

Various grant and funding programmes to help support your event in Singapore.

Team-Building Activities

Organise engaging and immersive team bonding activities against the vibrant backdrop of Singapore.

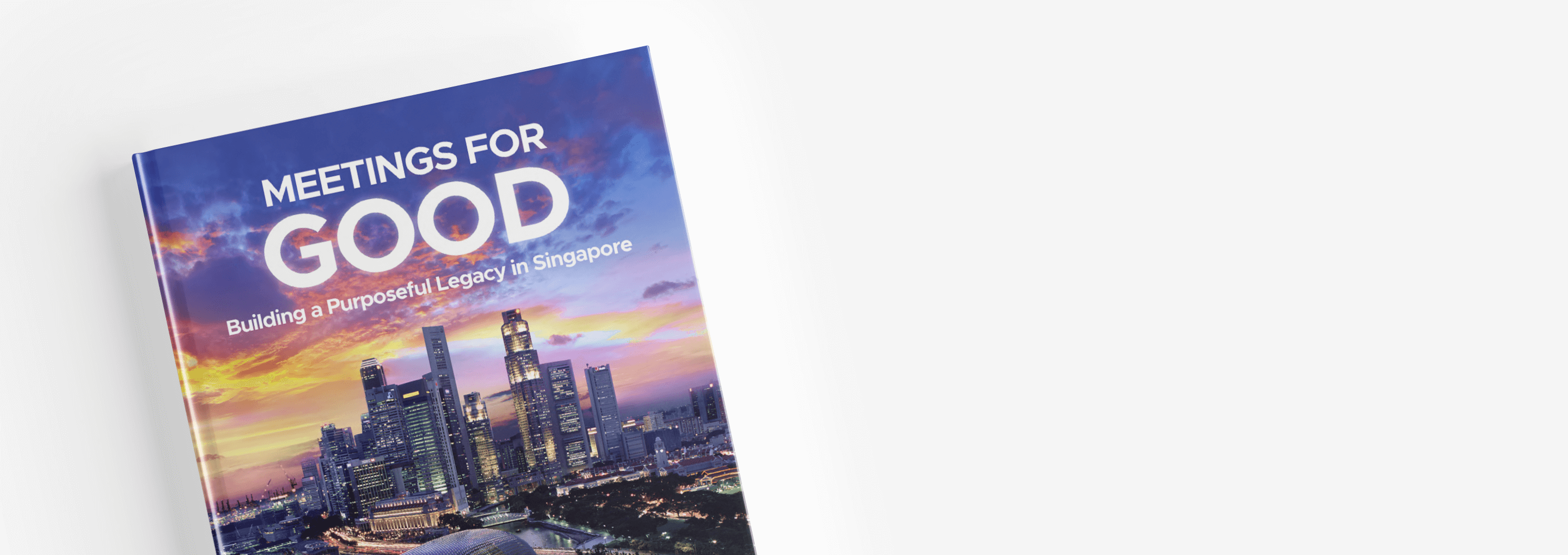

Meeting for Good

Meetings and business events have the power to drive long-term change in communities. The Singapore Exhibition & Convention BureauTM (SECB) works closely with associations and corporate event organisers to ensure that every business connection and leisure activity paves the way for positive impact. From engaging the community through roadshows to organising a charity run around our iconic landmarks, or reducing your event’s waste and carbon emissions, there are diverse ways for your event to leave a legacy of inspiring hope and fostering progress.

What's Next

Find out more about the upcoming MICE events happening in Singapore.

Request for proposal

Explore the possibilities and create unforgettable events. Our personalised specialists will be ready to help you wherever you are in, no matter your industry or size.